Take your business

further with a small business loan

Borrow £1,000 - £1 million with flexible repayments. Our small business loans can be used to buy new stock, invest in growth plans, or just keep your cash flow smooth.

-

24 hours to get a decision

-

Repay early with no fees

-

From 1 day to 2 Years.

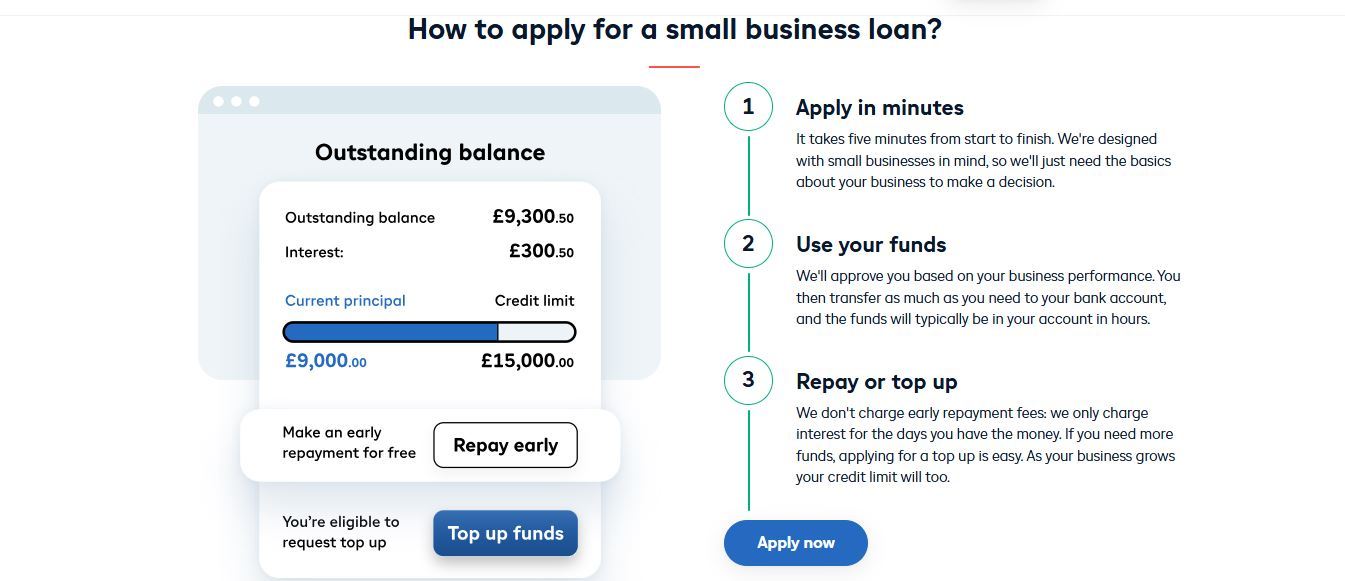

How to apply for a small business loan?

How do small business loans work

Small business loans can vary widely depending on the type, provider and sums involved. The general principle is that a lender offers either a set sum of money or a flexible line of credit (an agreed amount you can draw from) to use for whatever you need it for.

You then repay the amount you borrow over time, plus interest. Banks, credit unions and online lenders offer a wide variety of business loans, so it’s important to choose the right loan for your needs.

What kind of small business loans are available?

Given the huge number of businesses in the UK, there is a wide variety of small business loans available. The right option will depend on how much you want to borrow, how long for and what you’re planning to use it for.Small business loans can vary widely depending on the type, provider and sums involved. The general principle is that a lender offers either a set sum of money or a flexible line of credit (an agreed amount you can draw from) to use for whatever you need it for.

You then repay the amount you borrow over time, plus interest. Banks, credit unions and online lenders offer a wide variety of business loans, so it’s important to choose the right loan for your needs.

Small business loan FAQs

Here are some questions you could ask yourself about small business loans eligibility. If there’s anything we haven’t covered here, check our FAQ

How much is a small business loan?

The cost of a small business loan can vary significantly based on the type of loan, the loan amount, the term length, and the interest rate. For instance, our Flexi-Loan goes from 2% per month.

What is a good credit score to get a small business loan?

Unfortunately, your credit score alone is usually insufficient to determine your eligibility for a business loan. Most lenders consider many factors, including creditworthiness and interest rates.

The main thing to know is if your business is healthy. This includes checking if it has defaulted on debt, has any outstanding County Court Judgments (CCJ), and has a solid customer base with steady revenue. For those looking to learn more on the topic, we’ve put together a business health check tool.

How to get a small business loan with bad credit?

Securing a small business loan with bad credit can be challenging but not impossible. Here's how you can improve your chances:

Understand your credit score: before applying for a loan, understand your credit score and what factors led to it. This insight can help you plan on how to improve it

Improve your business’s financials: showing that your business is profitable or improvement in its financial health can make you a more attractive loan candidate

Consider alternative lenders: if traditional banks have turned you down, consider alternative lenders. they often have more flexible requirements and are more willing to work with businesses that have poor credit

Provide collateral: if you have assets that can be used as collateral, this can increase your chances of securing a loan

Seek a co-signer: if you can find someone with a strong credit score to co-sign the loan, lenders may be more willing to approve your application. However, this can be risky as the co-signer is equally responsible for repaying the loan.

Remember, obtaining a loan with bad credit can come with higher interest rates. It's essential to weigh your options carefully to avoid further financial strain.

When do I need to start repaying my small business loan?

Minimum repayments must be made either weekly or monthly, depending on the repayment schedule you agree to when requesting funds. With a monthly repayment schedule you will repay the first month 30 days after drawing down.